The Secret Strategy to Building Wealth

How does a person become rich?

I’m sure you can think of plenty of ways: have a job that pays a huge salary, win the lottery, buy Bitcoin in 2012, inherit a real estate empire, sell a Mike Trout rookie card. There are tons of possibilities.

But most of these stories have a big problem: they aren’t repeatable by an average person. It would be awesome to win 500 million dollars from a lottery ticket, but that’s obviously not a reliable strategy to build wealth. So what can we do?

Fortunately for us, there’s a foolproof method to getting rich that’s accessible to the vast majority of the population. It’s a little known secret that credit card issuers, retailers, and everyone else that makes up our consumerist society don’t want you to know. Surely this tactic must be insanely complex! Well, brace yourself, because the secret is:

Spend less than you make and invest the difference.

That’s it?? Yup, it really is that simple. If you spend less money than you make and invest the difference, you can begin to break free from a consumerist lifestyle and slowly become rich, eventually passively earning more from your investments than you ever earned working your job. The larger you make that investable difference, the faster you build wealth. And the earlier you start this process, the larger your wealth will grow.

But just because it’s simple doesn’t mean it’s easy. In fact, in this way, building wealth is the same as dieting; everybody knows that eating less and exercising more will make you lose weight. But anybody that’s ever tried to cut their calories will tell you it sucks. It takes discipline and can be an uncomfortable change at first.

It’s the same story when it comes to building wealth. Sure, it makes sense to spend less than you make, but doing so means you have to either reduce your expenses or increase your income, or both. Cutting expenses can be challenging in a society that relentlessly promotes consumption.

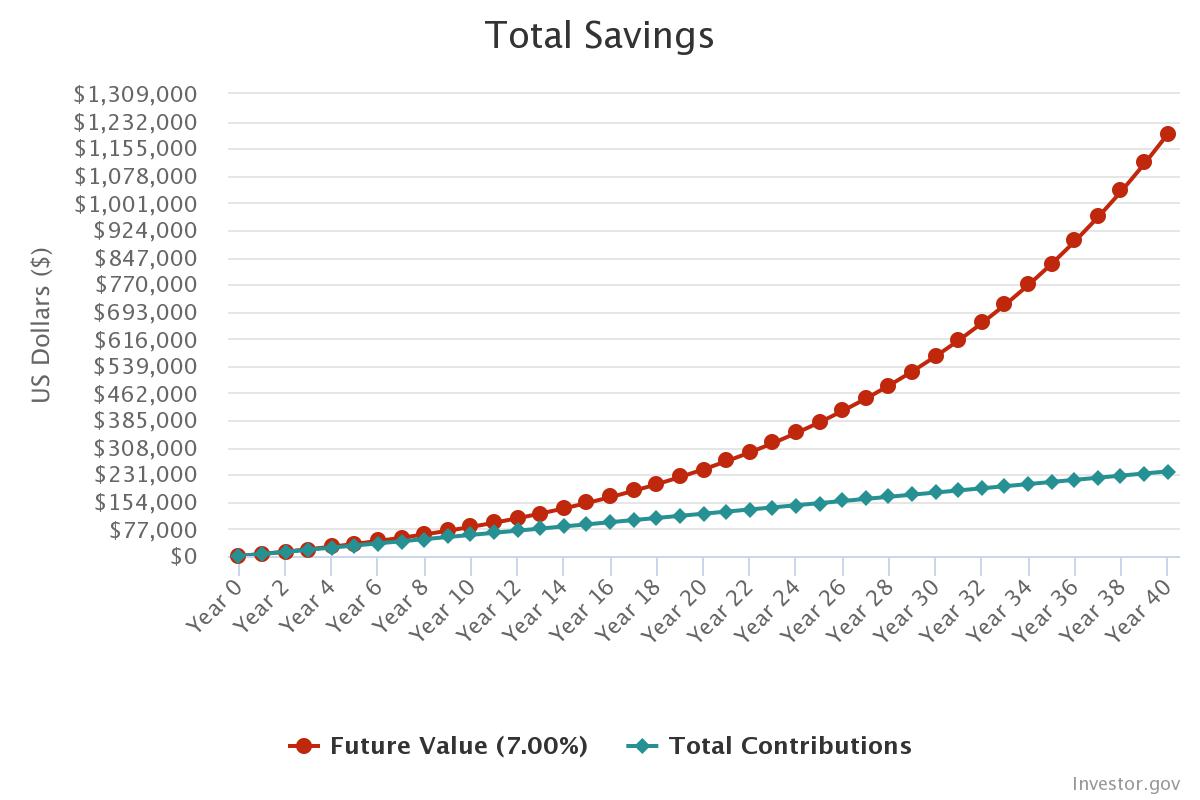

But let’s say hypothetically you’re able to spend $500 per month less than you earn and you invest that difference in a basic S&P 500 fund. We’ll touch upon why I chose the S&P 500, what that is, and how to invest in it (or other assets in the stock market) in a later post. Here’s what your investment looks like over a typical 40 year working career, assuming a consistent monthly contribution and an average 7% annual return.1

You’d have just under 1.2 million dollars!! And you’d have only invested $240,000! That’s a huge gain and an even huger amount of money. And all you had to do for that growth to happen was… nothing! It’s entirely passive.

And do you see how the Future Value (red) line starts increasing at a faster rate as time goes on? Long story short, the more money you have invested, the more money your money earns you. Year after year your wealth will be adding value to itself, then recruiting those additional dollars to add even more value to itself, and so on. This concept is called compound return, and when it comes to building wealth, it’s your best friend.

This simple formula is extremely powerful. All you have to do is find a way to make that leftover, investable amount each month as large as possible, since the more you invest, the more money you have working toward making you richer. And the earlier you invest, the longer you have for it to grow.

Since here at Explain Like I’m FI (and pretty much the entire FI community) our goal is to have the option to retire early, we don’t have 40 years to wait for our investments to grow, so we need to make up for the shorter time period by increasing the amount of money that we can invest.

There are two levers you can pull toward making that leftover sum larger: increasing the amount of money you earn, and decreasing the amount of money you spend.2 Since for most people, spending less is easier than earning more, that’ll be the low hanging fruit we tackle in the next post. Then once we go over a strategy to invest that money, you’ll be well on your way to financial independence.

-

People expect varying future returns from S&P 500 and/or total market index funds. Nobody can predict exactly what the growth rate will be over any period of time, but over long periods, the S&P 500 has averaged about 10% growth per year. I assume 7% since I’d rather underestimate the growth rate than overestimate it. I plan to write a post explaining just how relentlessly the S&P has grown over varying periods, at which point I will link to it here. ↩︎

-

If you, like the majority of Americans, have loans that you make monthly payments on, these payments are chunks of money that you could otherwise be investing each month. But that doesn’t necessarily mean that you should pay off a debt that you already have as quickly as possible to free up that monthly cash flow. You may be better off investing leftover money each month instead of paying off debt faster. See the post about this here. ↩︎