Investing Part 4: Manage Your New Portfolio

So far, we’ve covered some investing basics such as “what’s an investment?", an example of a simple, diversified investment strategy, and a few accounts that allow you to invest in the stock market. But some questions might still remain, such as “who manages my accounts/portfolio?” or “how do I actually use the money in my bank account to invest?”

Let’s cover these.

The Most Important Aspects of Your Investment Portfolio#

In order to answer the questions above, we’ll first need to understand some important aspects of an investment portfolio. For anybody looking to follow the simple path to financial independence, a couple of keys to ensuring success are to:

- keep the costs of investing low

- minimize the time and effort needed to manage their portfolio

Keep the Costs Low

Keeping the costs of investing low may seem obvious, but it’s frequently overlooked, especially when the difference between “expensive” and “cheap” may not be immediately apparent.

One type of fee that can eat into your earnings is referred to as an expense ratio, which is just the annual cost of owning shares of funds in the stock market. For example, some funds may charge its investors, say, 1% annually. This means that for every $10,000 you have invested in that fund, the issuer of that fund takes $100 each year.

Furthermore, using an advisor or portfolio manager to handle your portfolio for you will cost you another annual fee. Sure, you won’t have to make any decisions regarding your portfolio as long as it’s managed for you. But is it worth the cost?

Let’s say they charge 1.5% for their services, and they invest your money in an actively managed fund that costs 1% per year. That means that you’re paying 2.5% of the value of your invested assets per year to have your portfolio invested by somebody else into an expensive fund.

If we continue to assume an average annual growth of 7%, and you’re paying 2.5% to achieve that, you’re only getting 7 - 2.5 = 4.5% per year. Does that make a big difference? Let’s take a look.

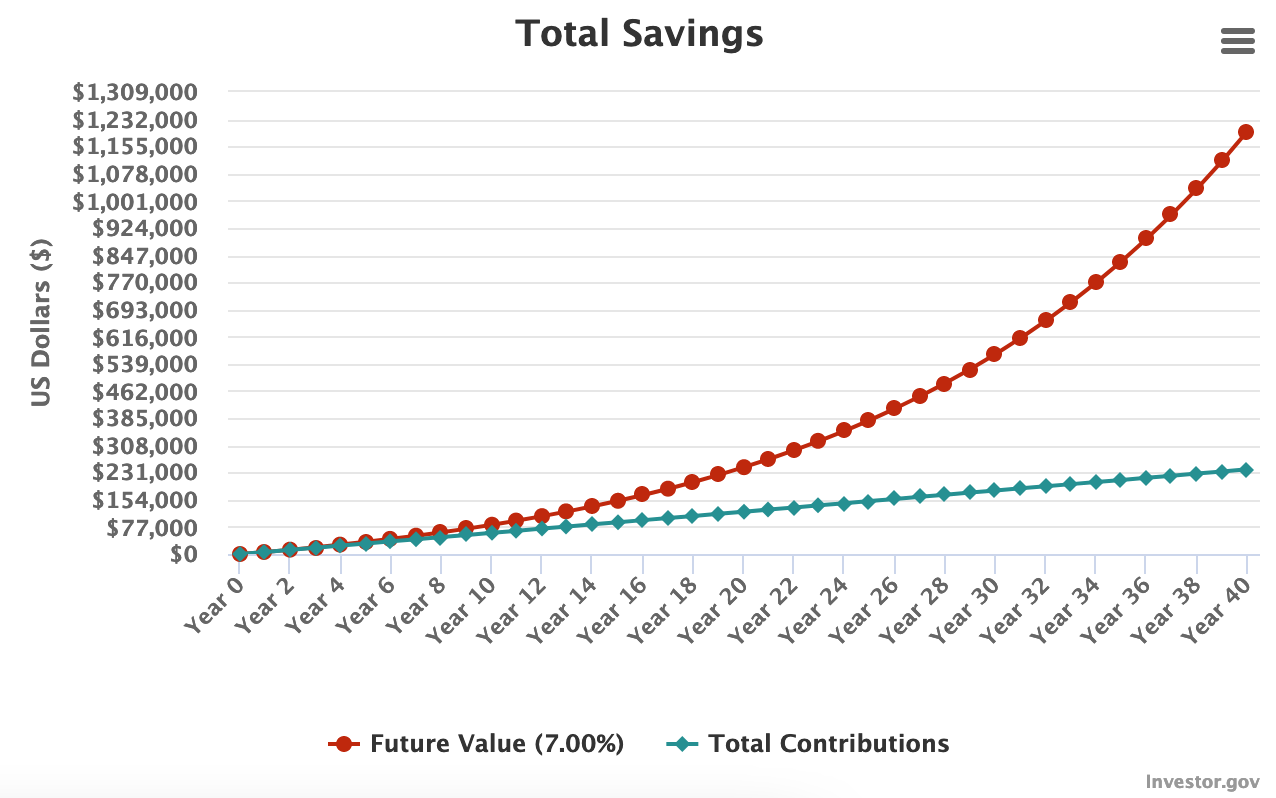

Here’s a portfolio starting with $0, with monthly contributions of $500 (assuming 7% annual growth):

You’d have $1,197,810.67 after 40 years.

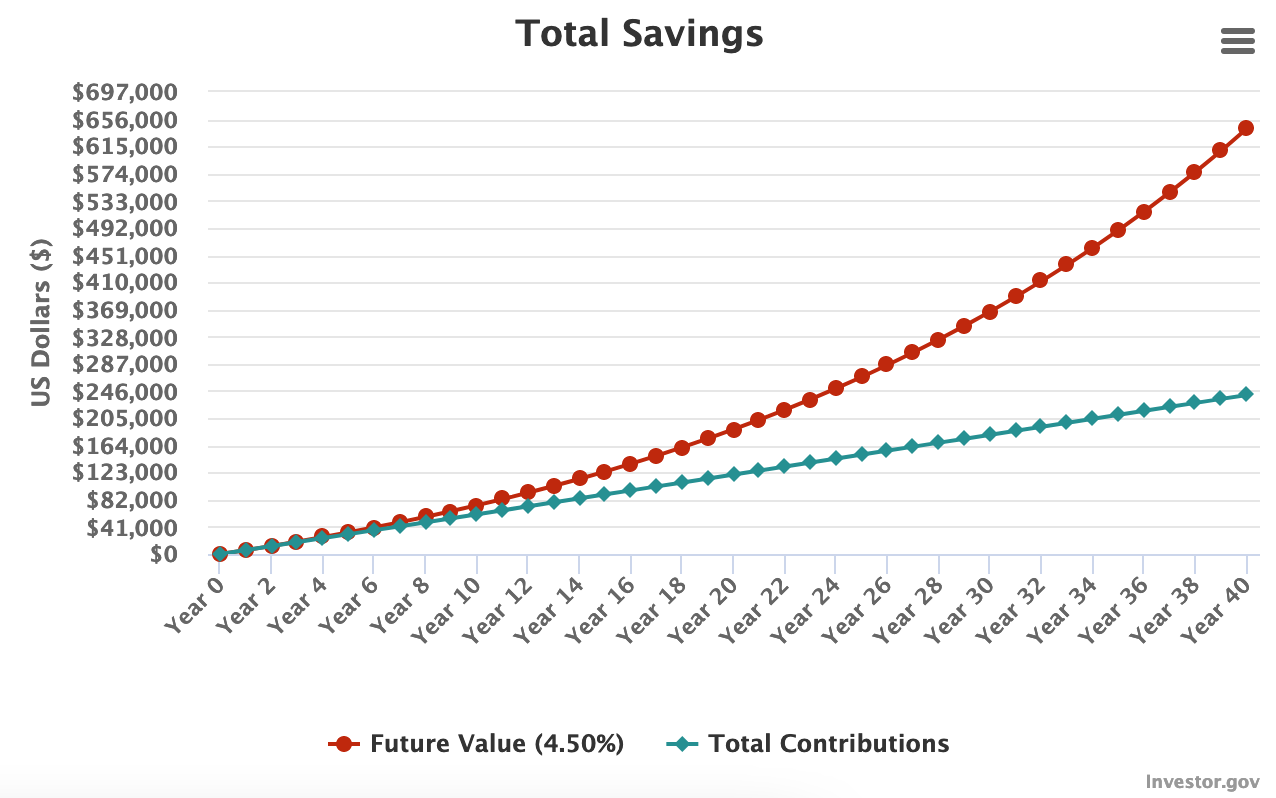

Here’s another portfolio starting with $0, with monthly contributions of $500 (assuming 4.5% annual growth, thanks to the high fees):

You’d have $642,181.94 after 40 years.

In other words, annual fees of 2.5% result in you having just over half of what you’d end up with when paying no fees in this scenario. To which the obvious response is:

Well, what if the high fee fund and manager are able to outperform by more than 2.5% per year? Then it’s worth it, right?

On paper, yes. But outperforming the market consistently is extremely difficult, let alone beating it by 2.5% to make the fees worth it. Do you think you have the knowledge and/or the luck to select an advisor or fund that will accomplish this for the rest of your investing lifetime? Good luck with that.

The solution, then, is to eliminate the cost of an advisor or portfolio manager by managing your portfolio yourself, and to also eliminate the cost of a high-fee fund by instead investing in cheap, broad market index funds (described in an earlier post here).

But that means I have to do more work!

Not only will it result in more consistent returns (and therefore more money for you in retirement), but it doesn’t even have to take up much of your time!

Minimizing Time and Effort with Automation

Minimizing the time and effort required to manage your portfolio is great for a few reasons: it frees up more time for other things that you enjoy; it makes the process simple and easy; it practically eliminates the risk of making mistakes or bad decisions. So how do we accomplish this?

The typical investment process is as follows: once you decide on a cheap, broad market index fund to invest in (again, covered here), all you need to do is transfer money from your bank account into your investment account. At that point, the money will be sitting there as cash - uninvested but ready to go. Then, you’d just use that cash to buy more shares of your selected fund. Other than waiting for the transfer between accounts to complete, it takes maybe five minutes of your time.

But we don’t want to spend five minutes; this should all happen behind the scenes.

Thankfully, both of these steps can be automated! You can set up direct deposit (or alternatively, automatic transfers from your bank account) in order to regularly get cash into the account. Then, you can also configure automatic investing to periodically buy mutual funds with any available cash in the account.

After completing these steps, you won’t have to spend any time at all in order to continue investing; your deposits and your mutual fund purchases will both be totally automated!

The process of configuring automatic investing will be similar across brokers. For example, the steps at Schwab are as follows:

- First, make sure you already own shares of a mutual fund (for example: SWTSX at Schwab, FZROX at Fidelity, and VTSAX at Vanguard are all total stock market funds that cost 0.04% per year or less)

- Hover over “Trade” in the navigation bar

- Under the “Mutual Funds” section, click “Automatic Investing”

- Follow the steps to select the fund, frequency, and amount of your choosing

Conclusion#

By combining the convenience of low cost index funds with the power of automated investing, you get the best of all worlds. You keep costs low, your portfolio grows with the market, and you don’t have to spend any of your valuable time making this happen. It truly is a set-it-and-forget-it solution to ensuring a comfortable, possibly early retirement.