How Much Money Do I Need in Order to Retire?

How much money would you need in order to retire?

The answer to this question is actually pretty straightforward. A person can retire when they have enough money to last the rest of their life. The slightly more challenging part is finding the smallest dollar value that fits the criteria. Every dollar past this amount will simply serve to allow the person to spend a little more each year in their retirement.

So with that in mind, let’s rephrase the question: what specific dollar value would allow you to live the rest of your life without ever needing to work again?

Ask this to ten people and you’ll get ten totally different answers. Some may say they could live off of $500,000, while others couldn’t imagine retiring with anything less than $3,000,000. Others still might claim they’ll have enough only when they win the lottery while the next person might say they’ll never retire at all.

There are tons of various thought processes and factors that go into calculating this retirement number; age, expected retirement length, cost of living, and the desired lifestyle in retirement are just a few of these factors. Calculating a retirement number is a complicated process that differs heavily between individuals and could never be put into a simple formula. If only it were that easy.

The Easy Formula for Calculating Your Retirement Number#

Surprise! There’s an incredibly easy way to calculate your retirement number, regardless of your cost of living, income, age, or anything else. The formula is as follows:

(Annual expenses) x 25

That’s it. Let’s go over an example. If I spend $30,000 total per year, and I can prevent that number from increasing faster than the rate of inflation (around 2-3% per year), I can retire when I have $30,000 x 25 = $750,000 invested in a total market index fund. It doesn’t matter if I’m 25 or 65 when I reach that number - I can retire.

It’s important to note that the “annual expenses” portion of the formula is not your current expenses, but your expected expenses in retirement. You can use your current expenses to get a ballpark number, but the target will likely shift as you get closer. For many people, their expenses actually decrease in retirement, since a typical part of a retirement plan is to pay off a mortgage beforehand.

Where Does “x 25” Come From?#

The concept of investing 25-times your annual expenses in order to retire comes from a research paper called the Trinity study (AKA the 4% rule). The study found that across all 30-year periods from 1925-1995, a withdrawal rate of 4% (ie. 1/25) was the highest rate that was “extremely unlikely to exhaust any portfolio of stocks and bonds”. This is because your portfolio, in theory, will grow faster than you’re able to withdraw from it.

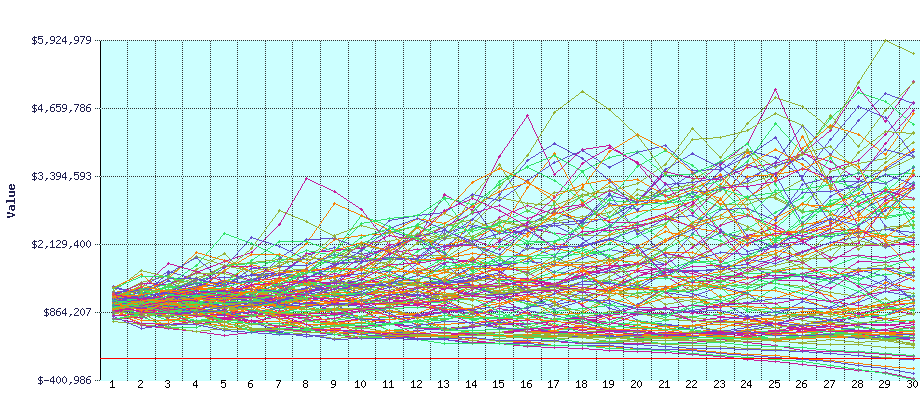

In fact, we can validate that this holds true using FIRECalc. On the right side home page in the box titled “Start Here”, you can enter in an initial portfolio value, your current annual expenses, and the time horizon of your expected retirement. It will return to you a graph depicting the possible values over time of your portfolio according to historical data, as well as the likelihood of that portfolio lasting the provided time frame throughout all of the simulations.

Entering into FIRECalc a portfolio of $1,000,000, annual expenses of $40,000 (4%), and a 30-year time frame provides us a 95% chance of our portfolio lasting the whole time. This means that if we were to withdraw 4% of our initial portfolio balance each year, adjusting for inflation, then only 5% of the time would our portfolio run out of money before 30 years passed.

It’s also worth addressing the other side of the chart: in many scenarios, we’d have even more money than we started with by the end of 30 years. In the best case scenario, we saw our portfolio grow to over $5.6 million! It all depends on what the market does during our retirement.

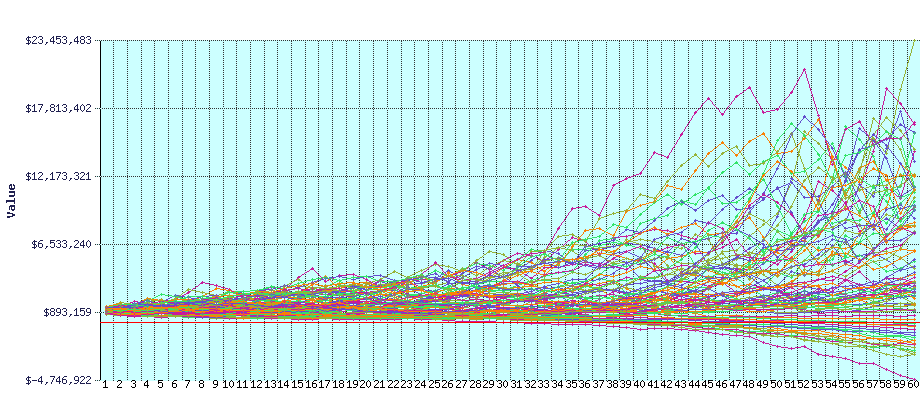

But 30-year retirements don’t interest us here. Our goal is to retire early, so theoretically our retirements will be much longer. What happens if we run the simulation again, but over 60 years?

Here we see an even wider array of possibilities, as well as a higher chance of failure. At this point, we have an 81.1% chance of our portfolio of $1,000,000 covering our annual expenses (initially $40,000) for 60 years. In the best case scenario, we see the portfolio grow to a staggering $23.4 million.

But the drop in success rate is significant enough to worry a lot of people. Certainly I wouldn’t retire with about a 20% chance of running out of money. So what can we do? Is this approach hopeless for us?

Safe Withdrawals for Longer Retirements#

The previously-mentioned 4% rule is a little less reliable for longer retirements, such as our hypothetical 60-year retirement. However, the Trinity study that populatized the 4% rule makes many assumptions, all of which are inherent in our simulations. It assumes that you:

- never get money from Social Security, an inheritance, or a pension

- never earn another dollar from side work, favors, etc. for the rest of your life

- keep your spending constant (adjusted to inflation) every year

In reality, these are likely not going to remain true. You’ll probably receive money from Social Security later in life (and therefore later in your retirement). You’d also have to be totally wreckless to not decrease your spending if a massive recession hit the economy. Combine those with the fact that people tend to naturally spend less as they get to their elder years, and you can imagine that the 4% withdrawl rate’s probability of success goes up.

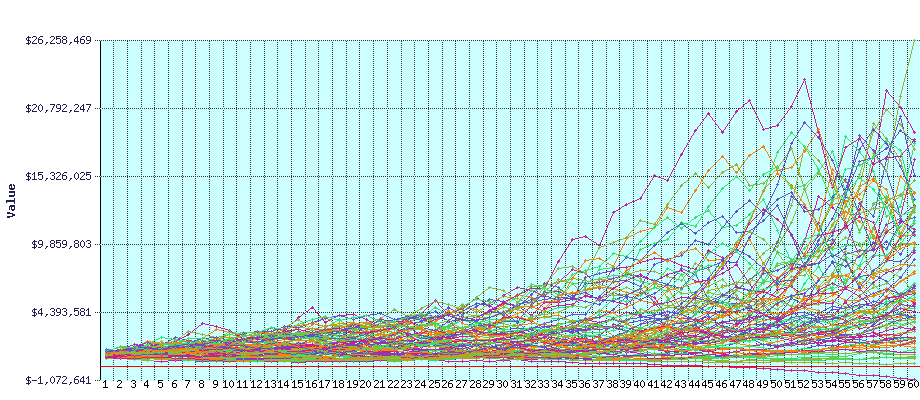

But what if you want to see a concrete positive change in the chart? For retirements that are significantly longer than 30 years, the simplest solution is to just work a bit longer or decrease your expenses in order to drop the withdrawal rate by a measly 0.5%, down from 4% to 3.5%. Let’s see what a chart depicting a $1,000,000 portfolio with $35,000 initial expenses (3.5%) over 60 years looks like.

98.9% chance of success, best case ending with over $26 million. Awesome. All this means is that, for retirements longer than 30 years, you can build in a significant safety margin by using a 3.5% withdrawal rate instead of a 4% withdrawal rate. That will require between 28-30x your annual expenses.

Conclusion#

The 4% rule is not perfect, but it’s a great way to ballpark your retirement number when you’re early in your career, and an excellent way to know approximately when you finally have “enough” later in your career. If you’re looking at a significantly longer retirement, a 3.5% withdrawal rate makes practically any length of time safe. While it should be used as a rule of thumb rather than a law that the financial markets will always abide by, these withdrawal rates are fantastic resources for setting goals and working your way to financial freedom.

Additional Reading

As always, my blog posts are written with the intention of keeping things easily digestible to those that are new to many of the concepts of personal finance and investing. If you’d like to dive much deeper into the concepts of safe withdrawal rates, have fun going down this rabbit hole.